Many Canadians pay off their mortgages each year without receiving any tax benefits. However, if you own a rental property or a rental basement unit, there is a legal strategy that can change this: it’s called Rental Cash Damming.

This approach allows you to convert your personal, non-deductible mortgage interest into deductible investment debt. The benefits of this method include larger tax refunds, faster mortgage repayment, and a more efficient use of the income generated from your rental property.

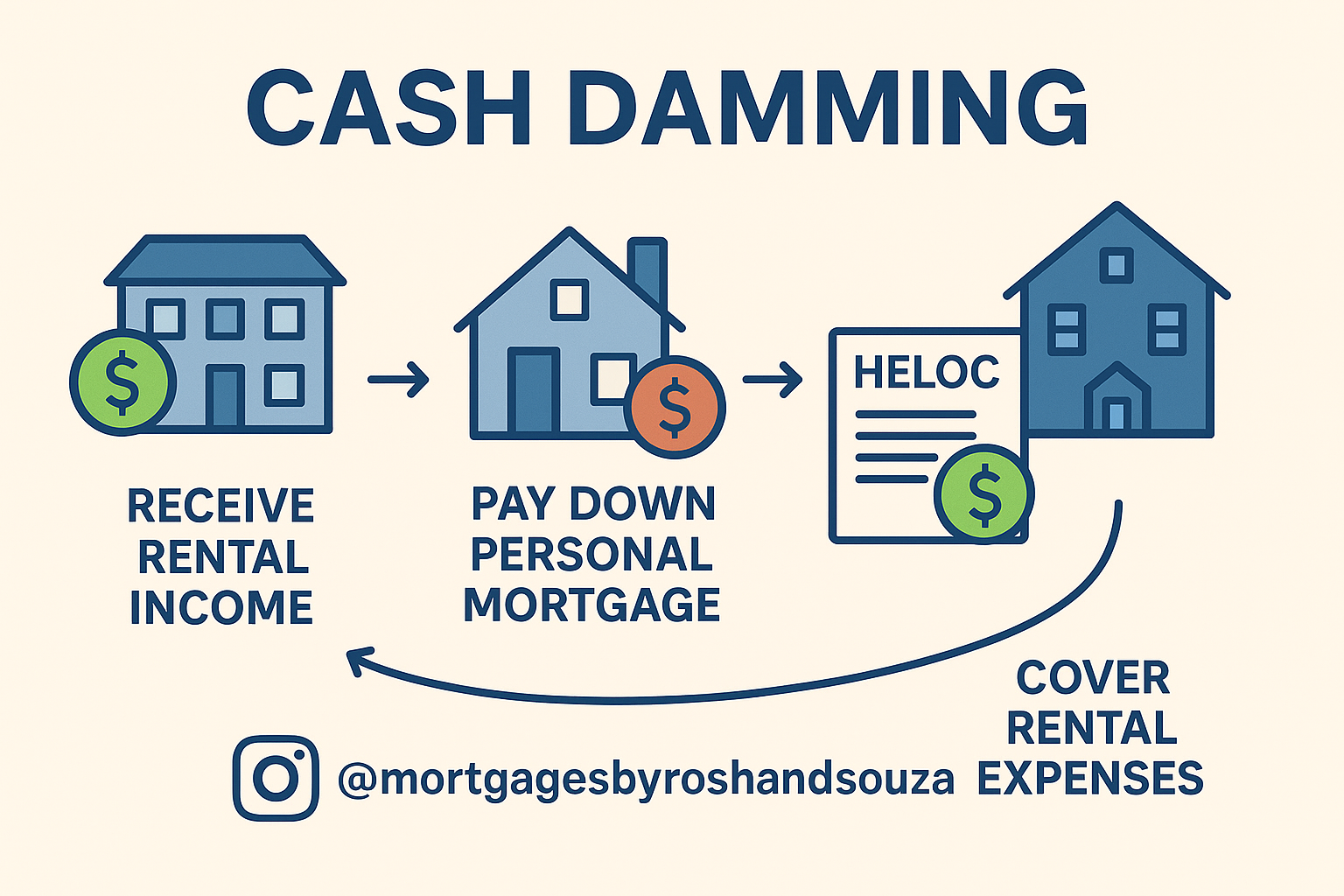

Here’s a simplified overview of how it works:

1. Use your rental income to pay down your home mortgage.

2. Re-borrow that same amount using a re-advanceable HELOC (Home Equity Line of Credit).

3. Use the borrowed funds to cover expenses related to your rental property.Since the borrowed money is used for income-generating purposes, the Canada Revenue Agency (CRA) allows you to deduct the interest.

Why is this important?

– It is fully compliant with CRA regulations.

– It does not increase your overall debt.

– It could save you thousands of dollars in taxes over time.

To effectively implement this strategy, you need the proper mortgage setup, thorough record-keeping, and a basic understanding of how to manage your cash flow.

Interested in learning more? Book a Call

You May Also Like…

What is home refinance and how to make sure you get the best deal in Canada.

Home refinance is a process where homeowners replace their existing mortgage with a new one, typically with different terms or a lower interest rate. It allows homeowners to take advantage of lower interest rates or change their mortgage terms to better suit their...

10 steps to save money for your home down payment in Canada

Saving money for a home down payment in Canada can be a challenging task, especially considering the high cost of real estate in many cities. However, with careful planning and discipline, it is possible to save enough money for your dream home. Here are 10 steps to...